Antibody-drug conjugates (ADCs) have been one of the hottest areas in the biopharmaceutical industry in recent years. Pharmaceutical giants such as Pfizer, AbbVie, AstraZeneca, and Merck are investing billions of dollars in breakthrough technologies targeting cancer treatment. According to the latest report from the market intelligence company Evaluate, in 2023, the total value of ADC-focused mergers and collaborations reached nearly $100 billion, more than three times the value of similar transactions in 2022, and more than nine times that of 2019. In 2023 alone, ADC candidate drugs developed by Chinese companies accounted for over 40% of global ADC licensing transactions. Currently, nearly 400 ADC drugs are in development worldwide, with nearly 200 in clinical stages. So, what magic does ADC hold? And which are the current hot targets and companies entering the field?

1. What is ADC?

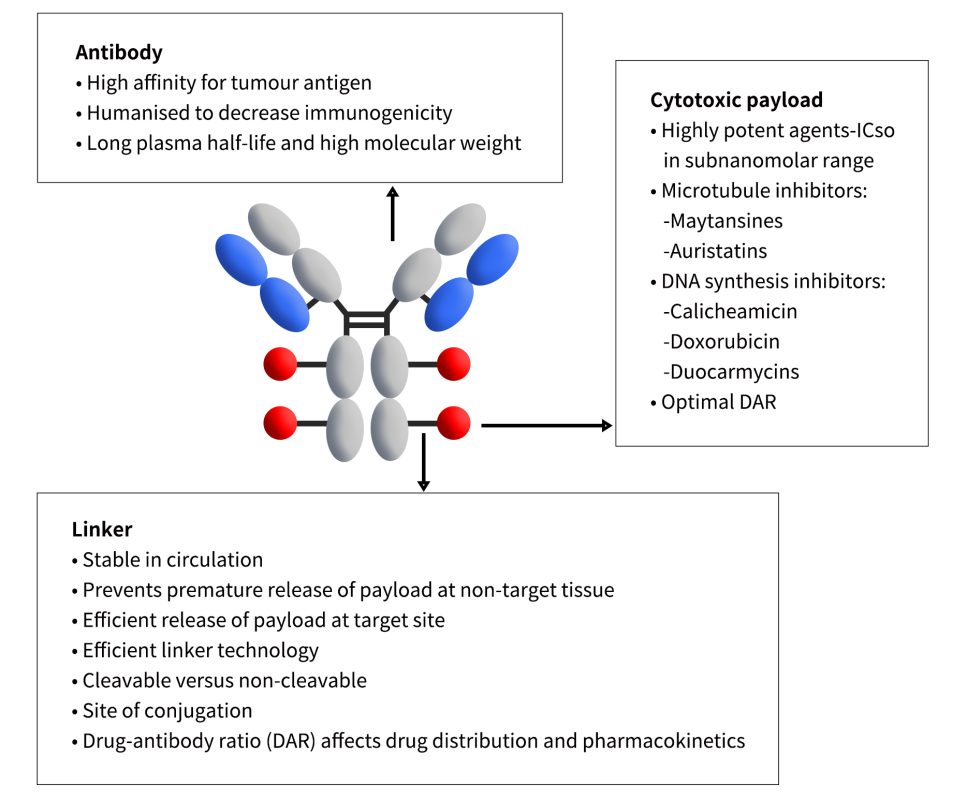

ADC primarily consists of three components: monoclonal antibodies, linkers, and cytotoxins. It combines the advantages of antibody drugs and chemotherapy, achieving precise and efficient killing of cancer cells, and has become one of the hotspots in cancer drug development. Among them, the antibody serves as the “navigator” of ADC drugs, with targeting functions that enable specific binding to tumor cell surface antigens and subsequent internalization (more information of antibody internalization), delivering cytotoxins to tumor cells and exerting toxic effects. The linker acts as a bridge between the antibody and the drug, controlling the release of drugs inside cancer cells and playing a major role in determining the pharmacokinetic properties, selectivity, and therapeutic index of ADCs. Cytotoxins, also known as ADC payloads, serve as the “bullets” of ADC drugs, and the activity and physicochemical properties of the payloads directly affect the anti-tumor efficacy of ADC drugs (more information of ADC payloads).

Figure 1. The structure of ADC [1]

2. Hot ADC Drug Targets

As mentioned earlier, there are nearly 200 ADC clinical projects, with over a dozen entering phase 3 clinical trials and nearly 130 in phase 1. Some of the more popular targets include HER2, CLDN18.2, TROP2, B7-H3, FRα, CD33, ROR1, CD70, CD276, IL3RA, and Nectin-4, most of which are mature targets with approved drugs and verified efficacy. Among them, HER2 has the highest number of investigational drugs, followed by CLDN18.2. Here, we will focus on several of the more popular targets.

2.1 HER2

HER2, also known as human epidermal growth factor receptor 2 or ERBB2, is a transmembrane receptor tyrosine kinase that belongs to the epidermal growth factor receptor family, which also includes HER1, HER3, and HER4. Under normal conditions, HER2 is expressed at low levels in various tissues and mainly functions to promote cell proliferation and inhibit apoptosis. However, when HER2 is overexpressed, it may lead to uncontrolled cell growth and tumor formation. HER2 overexpression has been found in various cancers, such as breast cancer, gastric cancer, lung cancer, ovarian cancer, and others.

Currently, there are three ADC drugs targeting HER2 that have been approved for marketing globally: T-DM1 (Trastuzumab Emtansine), T-DXd (Trastuzumab Deruxtecan), and RC48 (Vadastuximab Talirine). Among them, T-DM1, jointly developed by ImmunoGen, Roche, and Genentech, is the first solid tumor ADC drug approved for the treatment of advanced HER2-positive breast cancer. T-DXd, developed by AstraZeneca and Daiichi Sankyo, is the second HER2 ADC approved for marketing and is used to treat refractory HER2-positive metastatic breast cancer. RC48, developed by RemeGen, is a HER2 ADC and the first domestically produced ADC drug approved in China, indicated for the treatment of HER2-overexpressing locally advanced or metastatic gastric cancer in patients who have received at least two prior lines of systemic therapy.

Globally, 28 HER2-targeted ADC drugs are under investigation, with 8 in phase III clinical trials and 10 each in phase II and phase I trials. These projects involve numerous pharmaceutical companies both domestically and internationally, including Byondis (syd985), TOT Biopharm (TAA013), Kelun Pharmaceutical (A166), Jiangsu Hengrui Pharmaceuticals (SHR-A1811), Zhejiang Medicine (ARX-788), CSPC Med (DP303c), Shanghai Fosun Pharmaceutical (FS-1502), and DualityBio (DB-1303), among others.

2.2 CLDN18.2

Claudin18.2, also known as CLDN18.2, belongs to the Claudins protein family and is a gastric-specific tight junction protein expressed in various cancers, including gastric cancer, pancreatic cancer, and esophageal cancer. Currently, there are four Claudin18.2 ADC clinical trials in early stages, including LM302 by LaNova Medicines, SYSA1801 by CSPC-Med, CMG901 by Keymed Biosciences, and ATG-022 by Antengene Corporation. For more information on the progress of Claudin18.2 biopharmaceutical research, please refer to the CLDN18.2 blog paper.

2.3 TROP2

Trophoblast cell surface antigen 2 (TROP2), also known as tumor-associated calcium signal transducer 2 (TACSTD2) and epithelial glycoprotein 1 (EGP-1), is mainly overexpressed in various human epithelial cancers (such as breast cancer, lung cancer, gastric cancer, colorectal cancer, pancreatic cancer, and prostate cancer), but its expression is very low in normal tissues. Currently, the number of clinical projects involving TROP2 that have reached clinical stages is second only to HER2, totaling 16 projects, with 2 in phase III clinical trials and the majority in phase II. Pharmaceutical companies involved in the development of TROP2 ADC pipelines include Kelun Pharmaceutical (SKB264), Daiichi Sankyo Co., Ltd. (Dato-DXd), Shanghai Escugen Biotechnology (STI-3258), Hengrui Medicine (SHRA1921), Chengdu Bali pharm (BL-M02D1), and Hangzhou DAC Biotechnology (DAC-002), among others. For more information on the progress of TROP2 biopharmaceutical research, please refer to the TROP2 blog paper.

2.4 B7-H3

B7-H3 is a type I transmembrane protein and an important member of the immune checkpoint family. It is constitutively expressed on non-immune cells, including synoviocytes, osteoblasts, and endothelial cells, and is induced on the surface of immune cells such as dendritic cells, monocytes, and B cells. Several studies have shown that B7-H3 is overexpressed in various tumor cells, including melanoma, leukemia, breast cancer, and prostate cancer. Currently, there are a total of 8 clinical projects for B7-H3 ADCs, primarily in phase II clinical trials. Pharmaceutical companies involved in the development of B7-H3 ADC pipelines include MacroGenics (MGC-018), HANSOH PHARAMA (HS-20093), Daiichi Sankyo (Lfinatamab deruxtecan), BIO-THERA (BAT8009), DualityBio (DB-1311), and Mabwell Biotech (7MW3711), and so on.

2.5 ROR1

ROR1 is a type I transmembrane protein belonging to the receptor tyrosine kinase-like orphan receptor (ROR) family. In both children and adults, ROR1 is expressed at very low levels or is not expressed at all in most normal tissues. In contrast, ROR1 is expressed in various cancers, including hematologic malignancies such as chronic lymphocytic leukemia (CLL), mantle cell lymphoma (MCL), and solid tumors. Currently, there are 3 clinical-stage projects for ROR1 ADCs, with one in phase III clinical trials and two in phase I. The phase III project is Zilovertamab vedotin developed by VelosBio, which was acquired by Merck for $2.75 billion on November 5, 2020. The phase I projects include LCB71 by Chi-Med and NBE-002 by Boehringer Ingelheim. Similar to Merck, Chi-Med and Boehringer Ingelheim are not the original developers of LCB71 and NBE-002. LCB71 was initially developed by two South Korean biopharmaceutical companies, LegoChem Biosciences and ABL Bio. Chi-Med acquired LCB71 on October 29, 2020, for an upfront payment of $10 million plus milestone payments totaling $353.5 million. NBE-002 was originally developed by NBE-Therapeutics, and Boehringer Ingelheim announced its acquisition of NBE-Therapeutics for approximately $1.5 billion on December 10, 2020, thereby obtaining NBE-002. For more information on the progress of ROR1 biopharmaceutical research, please refer to the ROR1 blog paper.

2.6 FRα

FRα, also known as folate receptor alpha or folate receptor 1 (FOLR1), is a glycosylphosphatidylinositol-anchored protein rich in cysteine residues, with high binding affinity for folate and/or its derivatives. It plays a role in tumor infiltration, metastasis, and progression, making it an attractive target for cancer therapy. Currently, there is one FDA-accelerated approved FRα ADC drug, and an additional 8 are in clinical stages. The marketed FRα ADC drug is Elahere, developed by ImmunoGen, which received FDA accelerated approval in 2022. It is the world’s first and only approved FRα ADC drug. It is approved as a monotherapy for the treatment of platinum-resistant late-stage ovarian cancer patients with high FRα expression. Other FRα ADC drugs in clinical development include STRO-002 by Sutro Biopharma, CBP-1008 by Suzhou Coherent Biopharam, MORAb-202 by BMS, AZD5335 by AstraZeneca, and PRO1184 by ProfoundBio, and so on.

In addition to the mentioned targets, there are also many emerging targets under development for corresponding ADC drugs, such as CDH17, MUC1, DLL3, CEACAM5, and others. These targets are expressed in various types of cancer and are believed to hold therapeutic potential. The ongoing advancement in ADC technology and the expansion of target screening offer more possibilities for the development of these emerging targets, bringing hope for the future of anticancer therapeutics.

3. DIMA’s off-the-shelf ADC lead mAb molecules are driving forward ADC drug development

DIMA Biotechnology is committed to providing preclinical research products and services for druggable targets. In addition to offering recombinant proteins and antibody products tailored to specific targets, DIMA provides customized antibody services, including antibody humanization and affinity maturation, to meet individual needs. DIMA has revolutionized the antibody development process by establishing a vast collection of single B cell libraries targeting diverse drug targets. By leveraging these pre-developed and pre-validated B cell libraries, we can rapidly find over 10,000 lead mAb molecules within just 28 days, significantly reducing the time required compared to conventional antibody development approaches.

To expedite ADC drug development, DIMA has validated candidate antibodies through various assays, including cross-reactivity assessments between human and monkey proteins, as well as antibody internalization and cytotoxicity assays using our proprietary MMAE IgG labeling reagent (Cat. No. AME100003). Clients can receive these pre-validated mAbs immediately with validation data for their own functional assessment. For specific data or inquiries, please do not hesitate to leave a message or contact us at 400-006-0995 (China)/+1 (978) 912-0878 (USA).

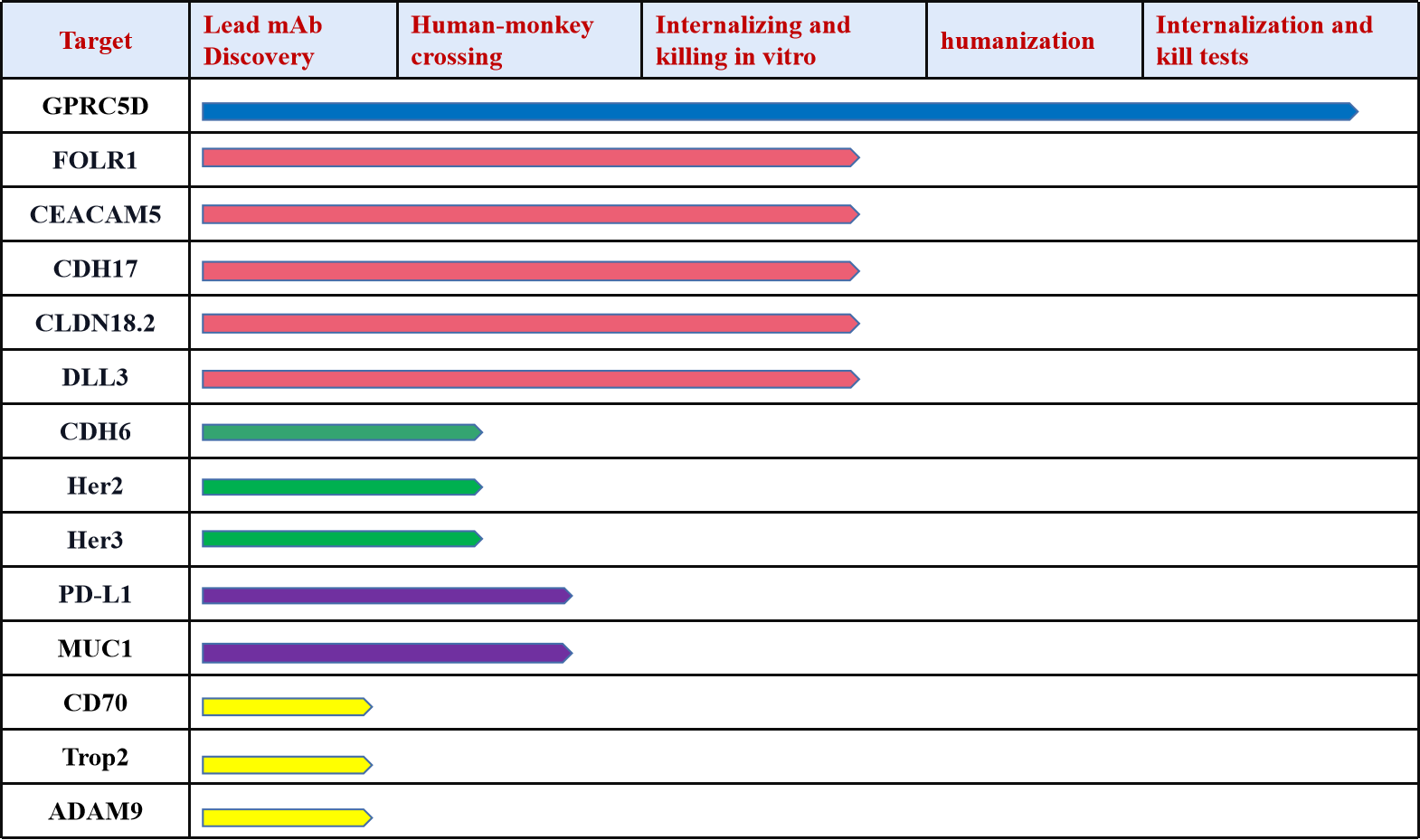

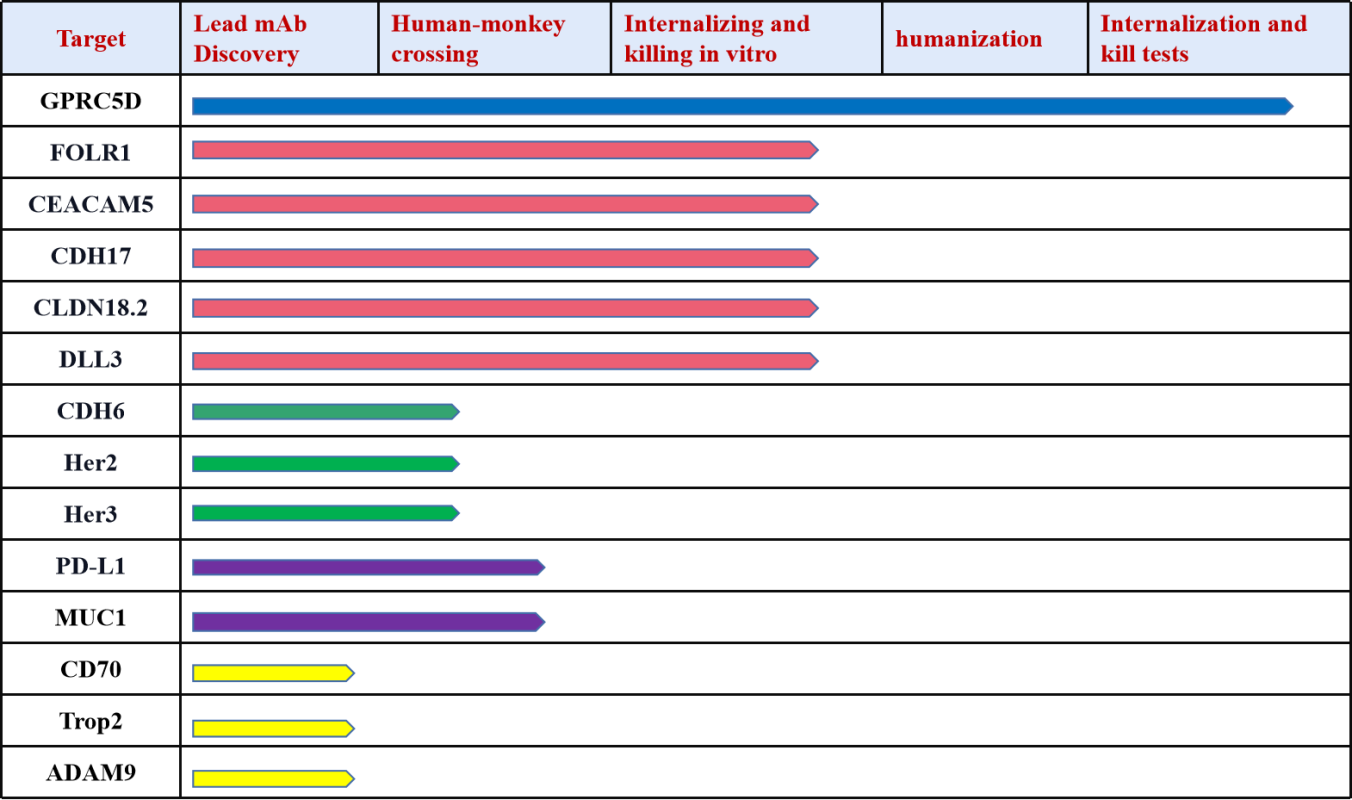

Below are some highlights of DIMA’s progress in popular ADC target projects:

Reference:

[1] Kang, M. S., Kong, T., Khoo, J., & Loh, T. P. (2021). Recent developments in chemical conjugation strategies targeting native amino acids in proteins and their applications in antibody-drug conjugates. Chemical science, 12(41), 13613–13647.