The American Association for Cancer Research (AACR) Annual Meeting is one of the most influential academic events in global oncology research. It brings together top-tier scientific discoveries and innovative drugs from around the world and serves as a weathervane for cancer research. At the 2025 AACR Annual Meeting, 111 Chinese pharmaceutical companies presented 246 innovative drug candidates, 86 of which were antibody-drug conjugates (ADCs), accounting for 35% of the total. Chinese ADC drugs have emerged in various forms such as bispecific ADCs and dual-toxin ADCs, forming a unique landscape at the AACR meeting. Here, we summarize the key players and target pipelines in the bispecific ADC (BsADC) space, based on AACR data.

1. Advantages of Bispecific ADCs

Often referred to as “magic bullets”, ADCs have been one of the hottest areas in the biopharmaceutical industry in recent years. However, with continued research into ADCs, traditional ADCs have shown limitations such as poor internalization, off-target toxicity, and drug resistance—especially in the treatment of solid tumors. These issues once stalled ADC development. Bispecific antibody-drug conjugates (BsADCs), which combine the advantages of ADCs and bispecific antibodies (BsAbs), have emerged as a promising approach to address these clinical challenges. BsADCs include dual-epitope and dual-target ADCs, which are the core designs in BsADC development. These unique binding modes allow BsADCs to simultaneously block two signaling pathways, enhancing tumor specificity and significantly improving antibody internalization.

2. Design Considerations for Bispecific ADCs

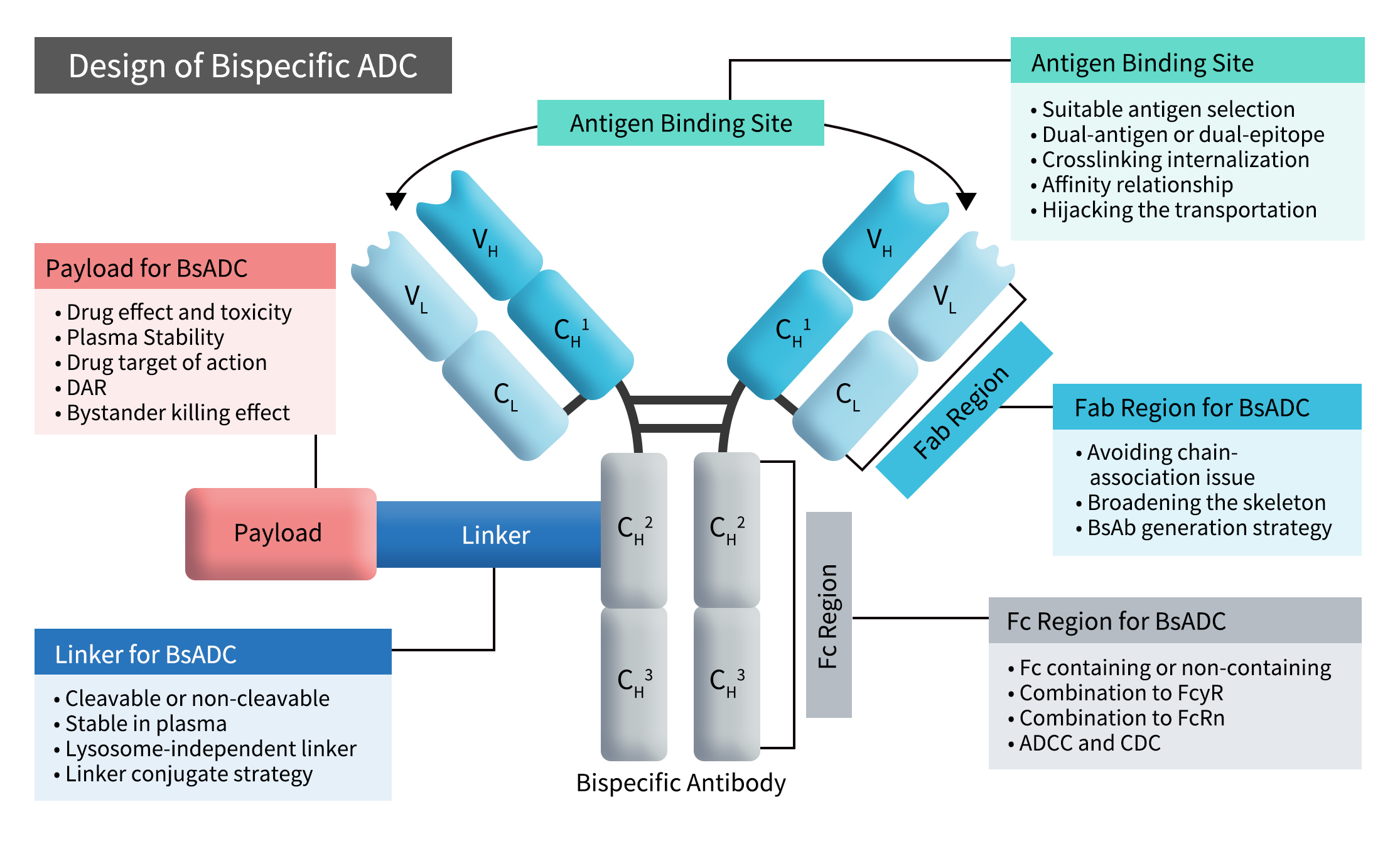

Early clinical data suggest that BsADC design is not as simple as a “1 + 1” formula. Changes in BsADC binding modes can impact overall efficacy, emphasizing the need for comprehensive coordination and optimization among BsAb structure, linker, and payload. Key considerations in BsADC design include the selection of antigen-binding sites, Fab and Fc region design, and linker-payload complex choices. Among these, antigen-binding site selection is the primary factor, which further involves target combination selection, binding models, crosslinking internalization, and cellular trafficking. Fab and Fc region design aims to address chain pairing challenges, BsAb generation, broadening antibody scaffolds, and exploring interactions with FcγR and FcRn. Lastly, the choice of linker-payload complex focuses on improving efficacy within BsADC design [1].

Figure 1. The concept and design considerations of BsADCs [1]

3. Clinical Progress of Bispecific ADCs

According to incomplete statistics, there are currently 19 bispecific ADCs (BsADCs) that have entered clinical stages globally, with only 3 in Phase III and 1 in Phase II trials. These include JSKN-003 and JSKN-016 from Jiangsu Alphamab, BL-B01D1 from Biotheus, and TQB2102 from Chia Tai Tianqing—all developed by Chinese companies. This highlights China’s leading global position in the field of bispecific ADC development.

Additionally, several preclinical BsADCs were disclosed in the abstracts presented at the 2025 AACR Annual Meeting. These candidates come from a strong lineup of pharmaceutical companies, including BrighGene, Orna Therapeutics, DualityBio, Hengrui Medicine, CStone Pharmaceuticals, Ginsei Pharmaceuticals, Kangyuan Biotech, Lanjin Biotech, Qide Pharma, Tuojin Bio, and Simcere Pharmaceutical. Among them, Ginsei Pharmaceuticals and Biocytogen have the largest pipelines. Among nearly 50 BsADCs, the targeted antigens are relatively concentrated, including:c-MET/EGFR (10 candidates), EGFR/HER3 (4 candidates), Folate receptor alpha (FRa) dual epitope (3 candidates), HER2 dual epitope (3 candidates), B7H3/PSMA (2 candidates), PD-L1/TROP2 (2 candidates), ROR1 dual epitope, among others.

3.1 EGFR/c-MET

EGFR and c-MET are both important and clinically validated targets in cancer therapy. They are overexpressed in various cancer types and are often associated with poor prognosis. Their signaling pathways are interrelated—activation of one can trigger the other—facilitating tumor cell proliferation, survival, invasion, and resistance to treatment.

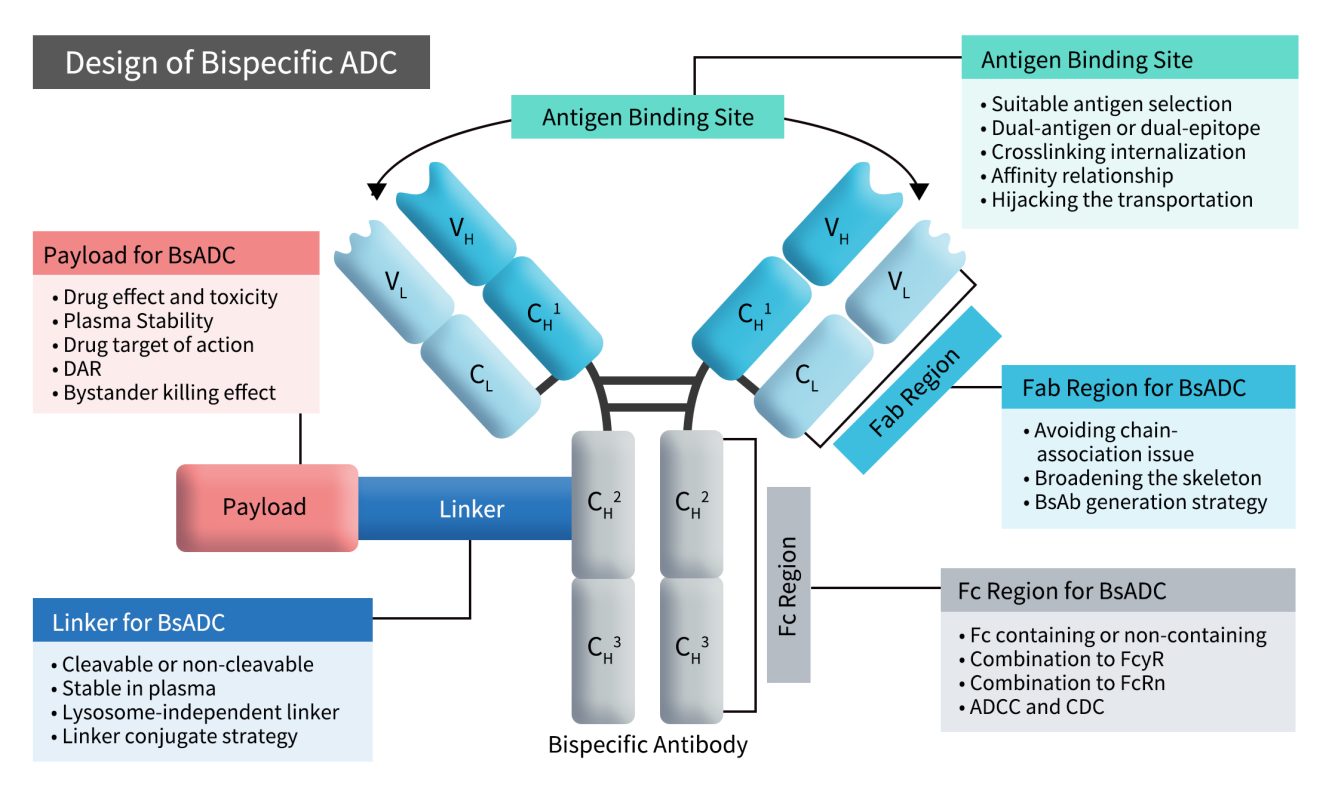

Currently, companies developing BsADCs targeting EGFR/c-MET include ProfoundBio, AstraZeneca, Biocytogen, Allink Bio, Novatim, CSPC Pharmaceutical, Simcere, Kyinno Bio, Genequantum, and Hengrui Pharmaceutical. Among them, ProfoundBio’s PRO-1286 is the most advanced in clinical development.

PRO-1286, originally developed by ProfoundBio (now acquired by Genmab), combines a bispecific antibody targeting EGFR/c-MET with the topoisomerase inhibitor sesutecan. At the 2024 AACR meeting, ProfoundBio presented preclinical data for PRO-1286. In November 2024, Genmab initiated a Phase I/II clinical trial, with completion expected in 2028.

AZD9592, developed by AstraZeneca, is another EGFR/c-MET BsADC. It utilizes a cleavable linker to conjugate a bispecific antibody with the topoisomerase I inhibitor AZ14170132 (AZ0132), with a drug-to-antibody ratio (DAR) of 6. This ADC primarily targets osimertinib-resistant tumors. AstraZeneca presented its initial preclinical and translational data at the 2023 AACR Annual Meeting. AZD9592 is currently in Phase I trials, both as monotherapy and in combination with other anticancer agents for advanced solid tumors.

Also in Phase I trials are DM005 from Biocytogen, ALK202 from Allink Bio. At the 2025 AACR Meeting, preclinical data were presented for the following EGFR/c-MET BsADCs: SWY2321 (CSPC), SCR-A006 (Simcere), KA-2886-LD38 (Kyinno Bio), GQ1033 (Genequantum) and E-cM-Topi (Hengrui Pharmaceutical).

3.2 EGFR/HER3

EGFR is a classic cancer therapy target, but the biggest challenge in its targeted therapy is drug resistance. HER3, another member of the epidermal growth factor receptor family, is commonly expressed across a wide range of tumors. EGFR and HER3 expression often co-occur in solid tumors, and HER3 overexpression is one mechanism of resistance to tyrosine kinase inhibitors (TKIs) in EGFR-mutant non-small cell lung cancer (NSCLC) [2].

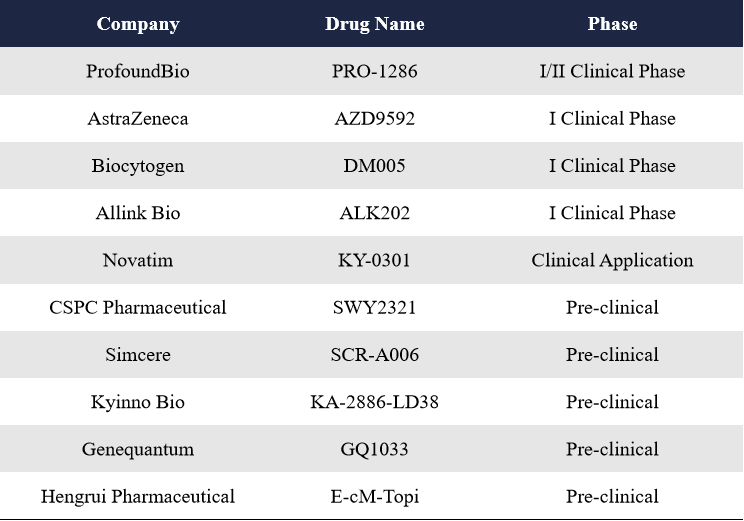

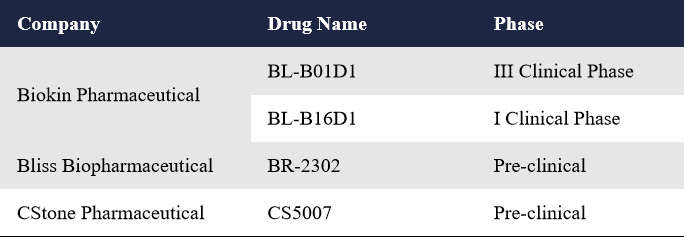

In response to this, Biokin Pharmaceutical developed the world’s first HER3/EGFR bispecific ADC, BL-B01D1. By targeting both receptors, this BsADC enhances intracellular trafficking and payload delivery, effectively overcoming drug resistance. In addition to Biokin, companies like Bliss and CStone Pharmaceuticals are also developing HER3/EGFR BsADCs.

Biokin Pharmaceutical currently has two BsADCs targeting HER3/EGFR, BL-B01D1 and BL-B16D1.

BL-B01D1 Combines the EGFR/HER3 bispecific antibody SI-B001 with a novel topoisomerase I inhibitor (ED04, a camptothecin analog) via a cathepsin B-cleavable linker. It is the first HER3/EGFR BsADC globally and the first to enter clinical trials. With strong structural design and promising clinical data, it was one of the most high-profile drugs at ASCO 2023. In December 2023, Biokin signed a global licensing and strategic collaboration deal with BMS for BL-B01D1, with an upfront payment of $800 million and a total deal value of $8.4 billion—the largest single-asset ADC deal globally to date. The drug is now in Phase III trials for multiple indications. BL-B16D1 Uses a microtubule inhibitor (MMAE-type) as the payload and is currently in a Phase I trial targeting head and neck cancer and other solid tumors. At the 2025 AACR Meeting, Bliss and CStone Pharmaceuticals presented preclinical data for their HER3/EGFR BsADCs, BR-2302 and CS5007, respectively.

3.3 EGFR-Related Bispecific ADC Targets

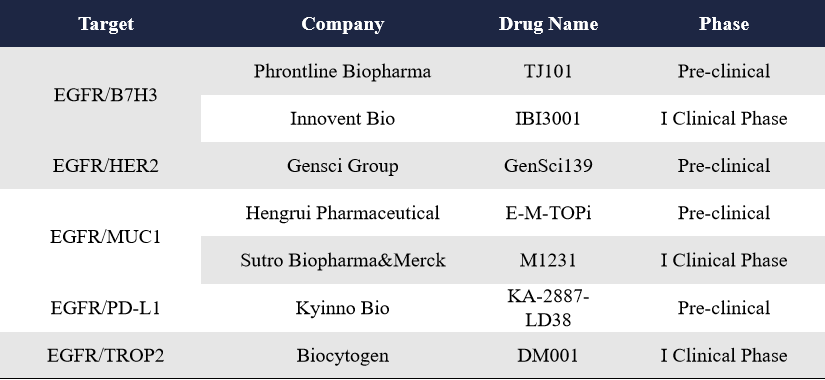

Beyond EGFR/c-MET and EGFR/HER3 combinations, EGFR also forms bispecific ADCs with B7H3, HER2, MUC1, PD-L1, and TROP2—all of which are well-established targets in cancer therapy. These candidates, IBI3001 (Innovent Bio, an EGFR/B7H3 bispecific ADC), M1231 (Sutro Biopharma&Merck, an EGFR/MUC1 bispecific ADC), DM001 (Biocytogen, an EGFR/TROP2 bispecific ADC), have already entered clinical stages.

At the 2025 AACR Annual Meeting, several companies also revealed preclinical data for their newly developed bispecific ADCs targeting these combinations, including Phrontline Biopharma’s TJ101 (targeting EGFR/B7H3), Gensci’s GenSci139 (targeting EGFR/HER2), Hengrui Pharmaceutical’s E-M-TOPi (targeting EGFR/MUC1) and Kyinno Bio’s KA-2887-LD38 (targeting EGFR/PD-L1).

3.4 Dual-Epitope ADCs for c-MET, FRa, HER2, and ROR1

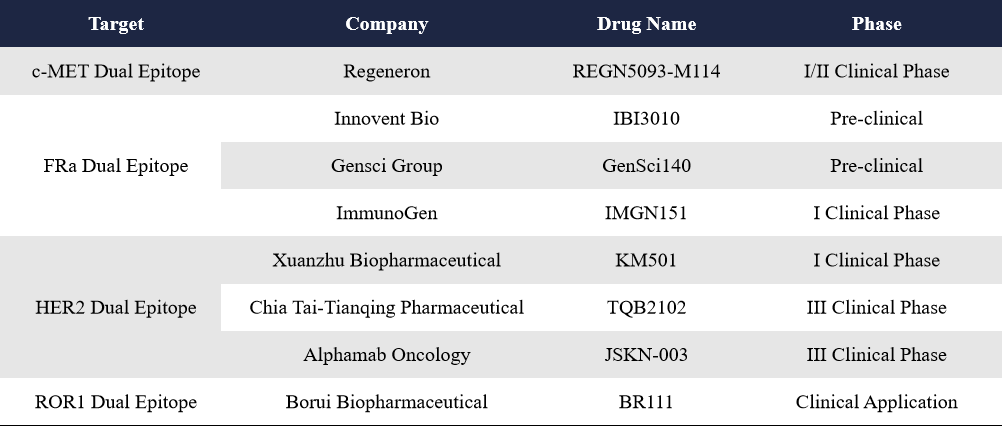

As previously mentioned, bispecific ADCs are categorized into two groups, dual-target ADCs and dual-epitope ADCs. Dual-target ADCs target two different antigens, which improves lysosomal localization and drug delivery. Dual-epitope ADCs target two distinct epitopes on the same antigen, which enhances receptor clustering and accelerates internalization. Globally, the number of dual-epitope ADCs under development remains limited. Targeted antigens include: FRa (3 candidates), HER2 (3 candidates), c-MET (1 candidate) and ROR1 (1 candidate). Representative companies involved include Chia Tai Tianqing, Alphamab, and Regeneron.

TQB2102, developed by Chia Tai Tianqing, targets two non-overlapping HER2 epitopes (ECD2 and ECD4). It consists of a humanized HER2 IgG1 bispecific antibody conjugated to a topoisomerase I inhibitor via a linker. In August 2024, the company launched a Phase III clinical trial in China—making it the second HER2 dual-epitope ADC to enter Phase III.

The first HER2 dual-epitope ADC to reach Phase III was JSKN-003, developed by Alphamab. JSKN-003 uses the company’s proprietary glyco-site conjugation platform and binds to HER2 on tumor cells, delivering a topoisomerase I inhibitor payload upon internalization. Compared to similar ADCs, JSKN-003 shows better serum stability, stronger bystander killing effects, and an expanded therapeutic window. In September 2024, Alphamab signed a licensing deal with CSPC Pharmaceutical Group, granting them exclusive rights for development, commercialization, and sublicensing of JSKN-003 for tumor indications in Mainland China (excluding Hong Kong, Macau, and Taiwan). CSPC is now the sole Marketing Authorization Holder (MAH) of JSKN-003 for these indications in China. In March 2025, JSKN-003 was granted Breakthrough Therapy Designation by the Center for Drug Evaluation (CDE) of China’s National Medical Products Administration (NMPA), for the treatment of platinum-resistant recurrent epithelial ovarian cancer, primary peritoneal cancer, or fallopian tube cancer—regardless of HER2 expression levels.

As for FRa, c-MET, and ROR1 dual-epitope ADCs, all are currently in early clinical stages. Innovent Bio and Gensci presented preclinical data on their FRa dual-epitope ADCs at this year’s AACR meeting.

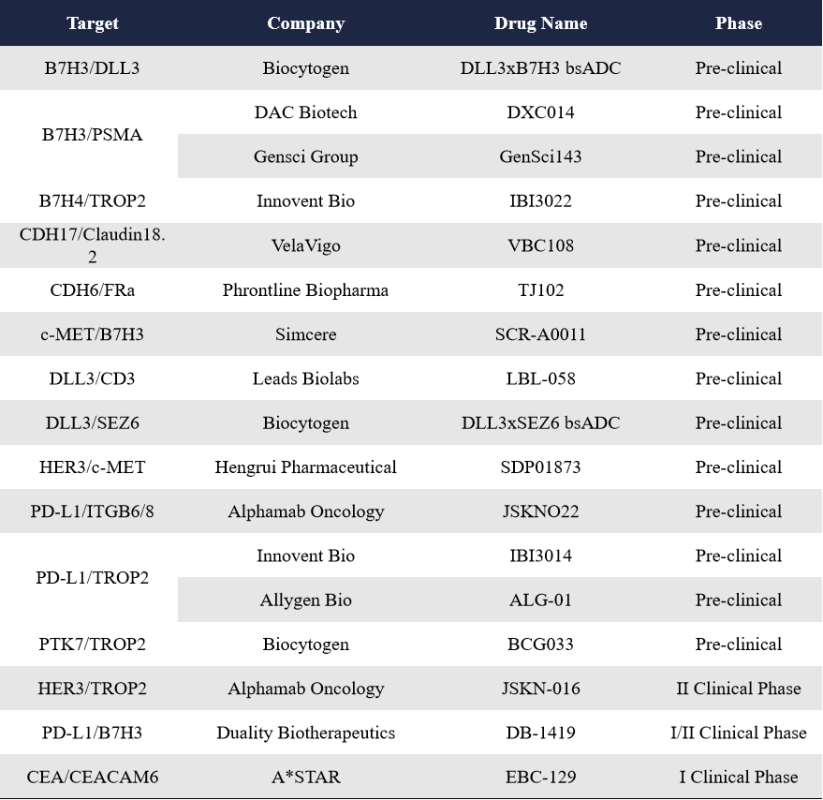

3.5 Other Developing Bispecific ADCs

Compared to the well-established traditional ADC pipeline, bispecific ADCs represent a relatively new and emerging field. Currently, the number of bispecific ADCs in clinical development remains limited, and the target landscape is still fairly concentrated. However, data presented at this year’s AACR meeting indicate a growing number of new players entering the bispecific ADC space, along with the emergence of novel bispecific target combinations such as CDH17/Claudin18.2, CEA/CEACAM6, and DLL3/CD3. Although these assets are still in preclinical stages, for many of the Chinese companies—who account for roughly half of the global bispecific ADC pipeline—this trend suggests significant opportunities for international expansion.

Biocytogen showcased preclinical data for three bispecific ADC candidates at AACR 2025: DLL3xB7H3 bsADC, DLL3xSEZ6 bsADC, and PTK7xTROP2 bsADC (named BCG033). Currently, Biocytogen has five bispecific ADC programs under development. Two of them—DM005 (EGFR/c-MET) and an unnamed EGFR/TROP2 bispecific ADC—have already entered Phase I clinical trials.

Innovent Bio presented preclinical data on three bispecific ADCs at 2025 AACR, involving two dual-target ADCs targeting B7H4/TROP2 and PD-L1/TROP2, one dual-epitope ADC targeting two epitopes on FRa. In addition to these preclinical assets, Innovent has one bispecific ADC—IBI3001—currently in Phase I trials, targeting both EGFR and B7H3.

Gensci introduced three bispecific ADCs at AACR 2025, including two dual-target ADCs (GenSci143 targeting B7H3 and PSMA, GenSci139 targeting EGFR and HER2) and One dual-epitope ADC (GenSci140 targeting two epitopes on FRa).

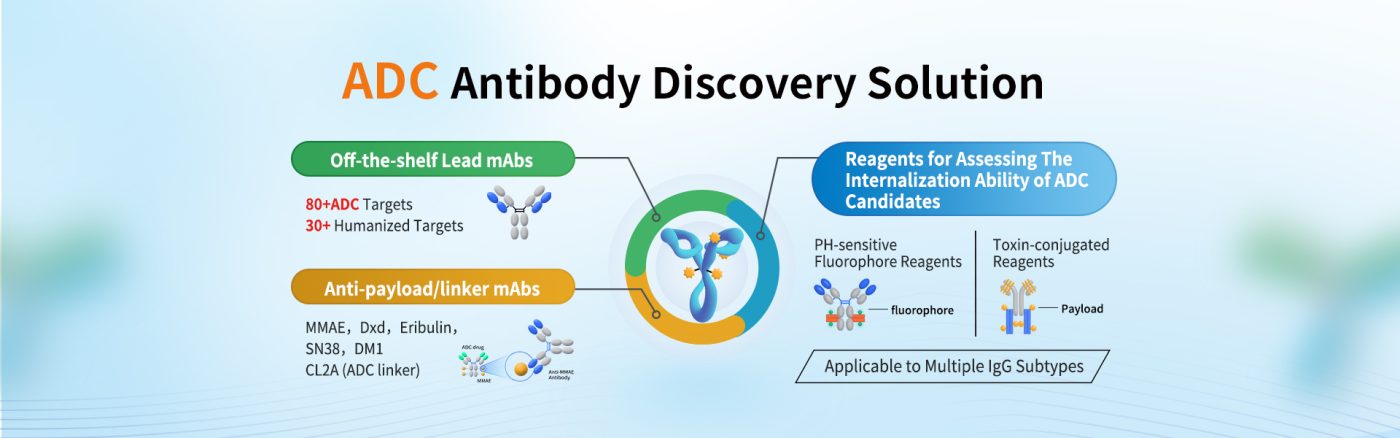

4. DIMA Biotech’s ADC Antibody Discovery Solutions

DIMA Biotechnology Co., Ltd. is a biotech company dedicated to providing products and services to biopharmaceutical companies. Unlike traditional CROs, we offer functionally validated, ready-to-use lead antibody molecules. To date, we have developed over 5,000 ready-made lead antibodies targeting more than 500 popular drug targets, all with defined antibody sequences and validated functional data. These antibodies are available for immediate acquisition and molecular testing—no waiting required.

In addition, for ADC antibody discovery, DIMA has established a comprehensive preclinical pharmacodynamic evaluation platform, specifically designed to support ADC development pipelines.

Reference:

[1]Gu Y, Wang Z, Wang Y. Bispecific antibody drug conjugates: Making 1+1>2. Acta Pharm Sin B. 2024 May;14(5):1965-1986. doi: 10.1016/j.apsb.2024.01.009. Epub 2024 Jan 20.

[2]4.Mol Cancer. 2018 Feb 19;17(1):38.5.Front Immunol. 2024 Jan 4:14:1332057.